The first step in evaluating diversification options is to analyze a tribe’s current customers, their demographics, desire for services and willingness to spend disposable income.

Next, applying two economic development principles can support tribes as they work to answer the diversification imperative:

1. Capturing incremental customer demand

2. Stage-based diversification

In the corporate world and even in the realm of small business, there are a couple of basic marketing strategies for business expansion that can be very useful to gaming tribes, particularly those who do not currently have other businesses outside of gaming. These strategies are related in that they both seek to grab more significant participation from a given customer.

The first step in evaluating diversification options is to analyze your current casino customers. It helps to literally visualize customers and think about what they are going to do with the disposable funds in the course of their visit or stay at the tribe’s casino. They will spend a certain amount on gaming, but how much would they spend on food? What kind of food would they prefer—fast food, buffet or fine dining? Would they spend money to stay the night? Would they bring their spouses if there were things for them to do? Would they bring their kids and pay for activities for them? Would they pay extra for higher-end services (i.e., valet parking, dry cleaning, spas and salons)? Are they in a hurry and want to enjoy gaming without all the distractions?

“When you start from a position of economic deprivation, the first time you see money coming into a community there is a thirst for it. So the biggest problem is the ability to suspend the desire for economic benefit for the time needed to invest and allow those businesses to grow.” — Rob Porter, Seneca

With these questions in mind, what other operations is the tribe capable of running? Getting to know your customers and what they spend their dollars on is a critical step in pursuing both strategies.

The logic behind these questions relies on the fact that most customers are willing to spend more money on things that are leisure-related if you can pinpoint the right type of product or activity or service that they want. By fulfilling their needs and desires, they will reward you with their spending. Across Indian country, we see this play out in the gradual expansion of gaming. Most tribes start with a small casino, often a converted bingo hall or a temporary roadside tent. Then, over time, as many generate sufficient gaming dollars, they expand.

The first step typically involves the construction of a more substantial, permanent, dedicated casino building. Then gaming-related amenities are added, usually starting with more and different dining offerings. Often, a simple restaurant or buffet comes first. As the casino grows, restaurants with different cuisines and price ranges are established. Finally, accompanying hotels, spas and golf courses are added to target the entire available spending power of existing casino patrons and attract new ones.

This sequencing is so common, we are not going to spend much more time analyzing it, but it is worth noting. As tribes look to diversify, the same diversification concept applies, it just must be taken a step further and viewed through a lens of new enterprise creation that is less directly reliant on gaming. First, it is important to understand how the following two traditional marketing principles can support tribes as they work to answer the diversification imperative.

Capturing Incremental Customer Demand

The notion of capturing Incremental Customer Demand (ICD) involves the alignment of a customer’s desire for additional products or services with the enterprises’ ability to fulfill those needs. Beyond conventional gaming strategies such as adding table games or hotel and resort amenities, customer research and market surveys can help tribes identify and pursue more innovative commercial options that casino patrons may be willing to shell out dollars for.

For destination resorts, this may mean a vast array of retail options where the traditional casino resort has expanded into an outlet-style shopping complex. Patrons tend to be tourists who come not just to game, but shop and enjoy contemporary cuisine. By broadening their focus well beyond gaming, Tribes are able to capture an entirely new range of purchases from the same patrons who frequent their casino.

With Blue Stone’s help, a Tribe in the Southeast United States conducted an examination of its customer base and found that despite offering a full-service resort, what the local community really desired was an event venue for weddings, debutante balls, graduations, and other social gatherings. Because of its quasi-rural location near multiple small towns situated on a strip of land stretching over 100 miles, the region lacked significant family-friendly entertainment and event space.

Further investigation of the customer demand illuminated a strong desire for multipurpose entertainment venues such as modern bowling alleys. In Blue Stone’s experience, bowling alleys are rarely profitable and rarely a strong diversification option. However, in this particular case study, there was a quantifiable high customer demand for a facility that provided a range of entertainment formats (youth-oriented late-night bowling, weekday bowling leagues, slots for birthday bowling parties, and sports bar and gaming-related formats). Nearby bowling alleys were few and far between (about 30 miles apart), outdated, and primarily catered to day-time leagues. Furthermore, adult-oriented nightclubs were also non-existent despite a large under-forty single population in the area.

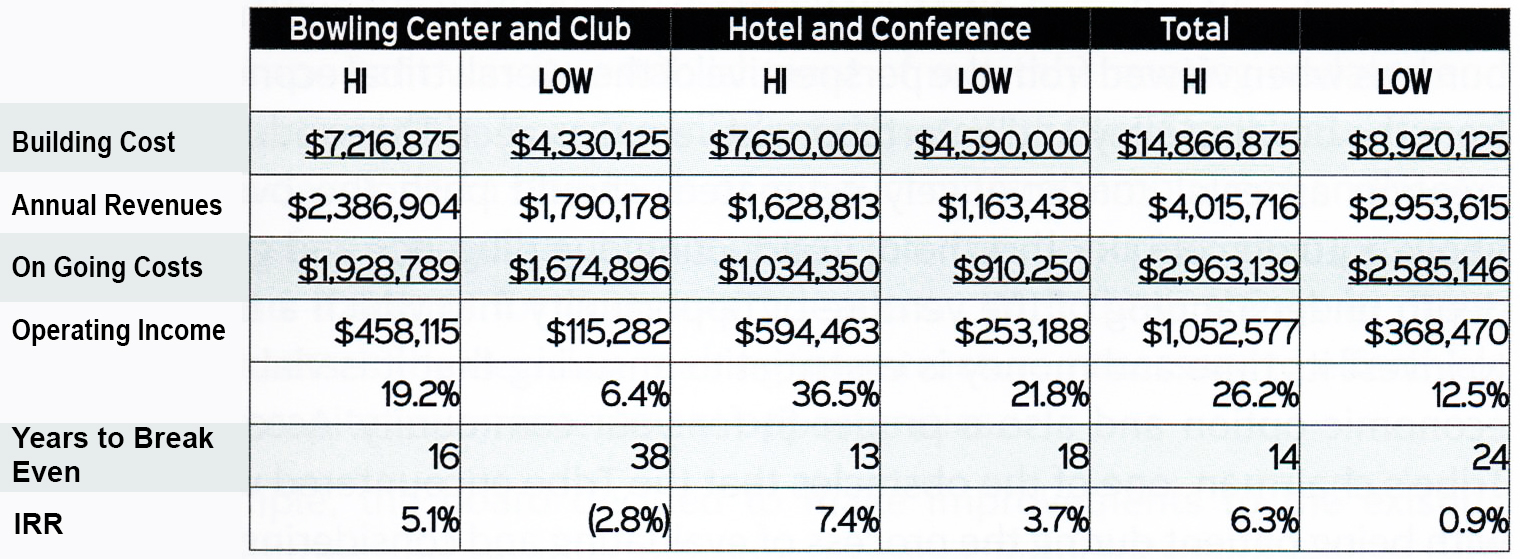

Working with estimates combining various development options, Blue Stone blended together a mid-range hotel, conference/event space, bowling alley and nightclub, producing a formula for diversification that stood a good chance of effectively answering local customer demand. Each of these entities by themselves were not likely to be economically viable, but when combined into a single format customized to local needs and conditions, the overall enterprise showed the potential for significant financial returns. Below is an illustration of the options that the Tribe considered.

Illustrative Summary: Steady State Pro Forma

Internal Rate of Return (IRR) is a measure of the cost vs. benefit of the project’s overall worthiness based on both the upfront construction costs and the future estimated gross earnings after overhead costs. This measure assesses the percentage of cash flow compared to the initial costs of the project over a 20-year period, growing at a modest three percent per year. It should rise above the cost of capital in order to be deemed a feasible project. The above figures are meant to support a decision to further investigate feasibility; they are not intended to be official feasibility estimates, which should come from building contractors. For example, based on these estimates, the bowling center would take the Tribe up to 10 years to pay back the construction costs, while the hotel would take longer because of the steeper construction costs. The idea of diversification requires these kinds of long-term, strategic decisions.

Tapping into incremental customer demand also tends to increase the crossover value of existing gaming and other enterprises, when properly connected through cross-marketing and loyalty programs. In this particular example, synergies with its casino and the identified community benefits added further value to the project. The longstanding desires for both family and nightclub entertainment would be answered by this approach, in addition to incremental new revenues and profits generated from increases in:

- The overnight stay percentage of current casino patrons

- Casino customers pulled in by the bowling center and/or hotel

- Bowling center revenues from potential slot locations inside the facility

- Convenience store and Dairy Queen customers

- RV customers

- Movie theater customers

- Number of golfers

Taken together, these factors—even if not that impactful individually— provide a healthy financial buffer against lagging performance and fixed-cost burdens when viewed from the perspective of the overall tribal economic benefit from the bowling alley and entertainment venue project. These additional value creation aspects, conservatively estimated, should push the overall project above a 10 percent IRR threshold. Conducting due diligence and gaining an in-depth understanding of the venture or opportunity into which a tribe is going to invest its time and money is essential to ensuring that it is viable long-term economic option and also a proper fit for your community. According to the Tribe’s chairman, one of the obstacles that the Tribe encountered was difficulty with being patient during the process of evaluating and considering the array of economic development opportunities.

At the root of this inactivity was a clear lack of alignment between the Tribal Council and its business board. The business board did have an organizational structure in place, but it lacked guiding policies and procedures, an investment strategy, an approach to ensure due diligence, and internal systems, contributing to a mindset among board and staff that, “any idea is a good idea”— which certainly did not engender much confidence among Tribal Council or community members.

Blue Stone worked with the Tribe to examine and improve its existing policies and procedures and developed new ones designed to facilitate its economic diversification efforts. The Tribe’s economic development corporation (EDC) had been in place for 17 years, however, during this time it had not made any investments on behalf of the Tribe, raising concerns among tribal members. Consisting of a governing board and three staff members, the operating budget was roughly one million dollars per year to operate, but had done little to justify or recover that cost. Although the Tribe was allocating funds to operate the entity, there was no agreement on or approval to move forward on investment opportunities.

With the assistance of Blue Stone, the Tribe developed internal systems, instituted onboarding and training processes for all business board and staff members, and formalized and approved a clear due diligence process that outlined a step-by-step process by which the board would consider acquisitions or joint ventures. It also developed dashboard reporting for the board and Tribal Council, enabling members to quickly review data and the progress of each investment opportunity in order to identify and address risk factors and craft a diversified investment strategy. In addition, the Tribe designed a plan to create clear lines of communication between the board and Tribal Council and fully define the roles and responsibilities of each as well as reporting structures and policies governing the relationship between the two.

Equally important was its establishment of monthly meeting updates and quarterly reporting by the board to tribal members. With Blue Stone’s assistance, the Tribe also developed a standards-of-conduct manual, employee handbooks, an Indian preference policy, and a tribal job creation plan that provided education and trainings for community leaders. With these things in place, the Tribe possesses the decision-making infrastructure necessary to effectively evaluate and capitalize on investment opportunities.

For example, the board decided to make improvements to the existing convenience store and product offerings to meet industry standards. It also developed and finalized a feasibility study for a second convenience store, which would produce an estimated 120 percent return on investment and payback in just three years. Blue Stone helped the Tribe secure Bureau of Indian Affairs loans to fund the project and assisted with the necessary project management trainings. The project is currently under construction and will be located adjacent to the Tribe’s gaming operation; is expected to employ 16 tribal members; and will likely produce over a million dollars annually in revenue from profits and taxes back to the community.

This example illustrates two principles: 1.) Understanding the opportunities for capturing incremental customer demand and 2.) Understanding the impact that new diversification projects can have on existing projects in terms of meaningful returns for the tribal economy.

In this case, there also was the added social benefit of providing space for family and friends to gather near the community rather than having to drive long distances. This type of traditional approach to diversification is particularly helpful for tribes who have exhausted their initial set of diversification options, such as resort amenities and convenience stores. Our next example examines how another traditional marketing strategy can help a Tribe diversify its customer base rather than enterprises.

Stage-Based Diversification

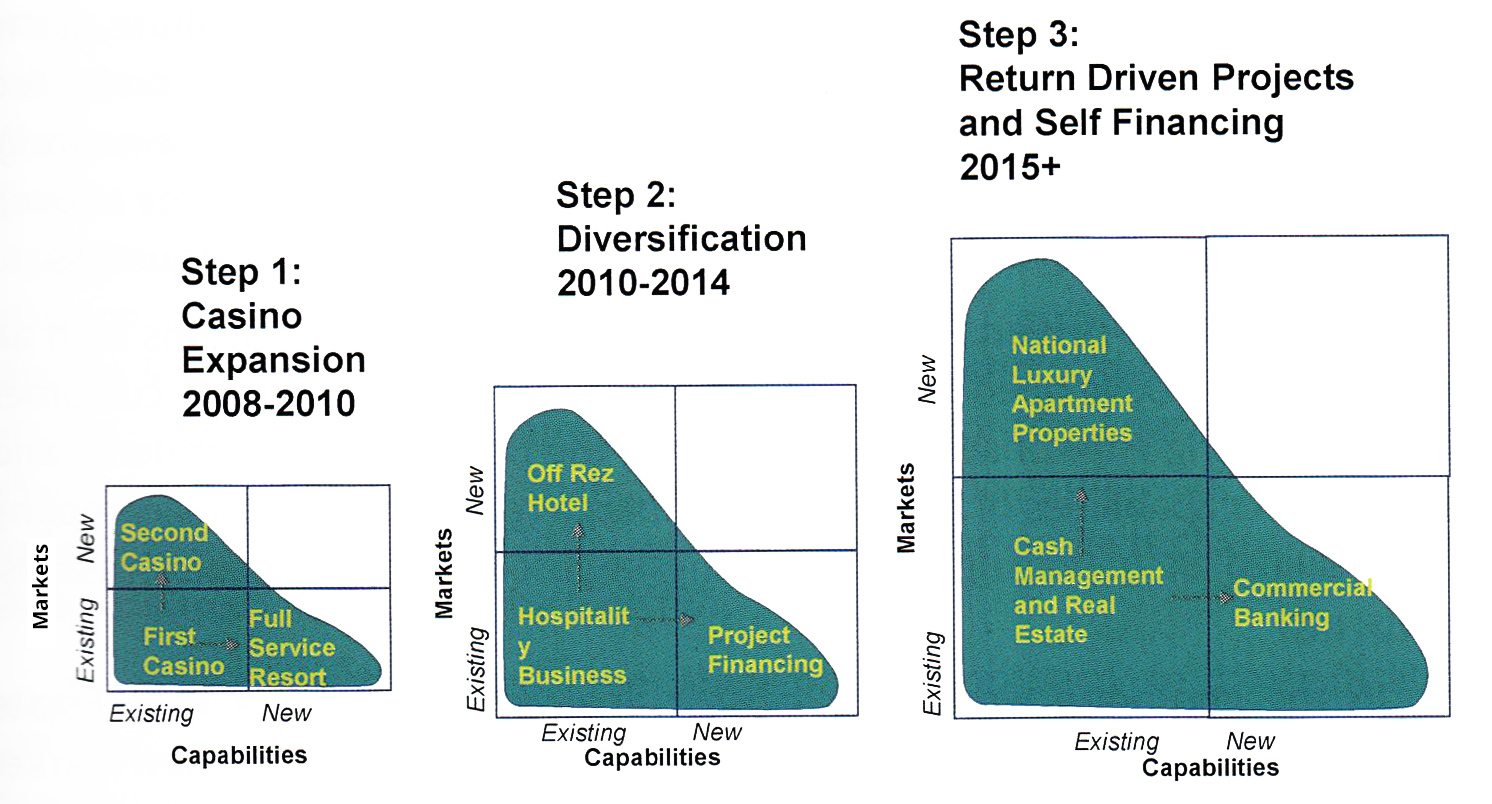

This concept is referred to under many different labels, but for the purposes of this article we will rely on the label coined by Dartmouth University professor Chris Trimble: Stage-based Diversification—the notion that a Tribe or its business entity faces fundamental choices when it comes to expansion. It can either pursue new markets for the products or services it currently provides or it can pursue new capabilities to produce new products and services; however, it likely will not be able to pursue both new markets and new capabilities at the same time. This fundamental insight enables expansion and diversification opportunity mapping over time, as shown in the following graphic.

To illustrate this methodical progression towards economic diversification, consider the example from a Tribe in California. Its reservation is located in southern California nearly 30 miles from the Mexican border surrounded by forests. The Tribe has occupied their region for more than 10,000 years practicing their customs, traditions and engaging their community. Today, they have developed one of the most modern government and business enterprises in Indian country. The tribal members agree that the lands are to be used to capitalize on the value of the property without compromising their cultural respect for the lands.

Step 1 (Casino Expansion), the Tribe will begin by building its first gaming facility. After several years of operation, the Tribe will have developed a management team and supporting cast of individuals with skill sets or capabilities necessary to effectively run a casino. A natural next step is to then leverage those capabilities into expanding gaming operations by building a second casino to reach a new market. This could be located in a different area of the reservation or it could seek to target a different part of the same geographic market in order to offer higher-end amenities to more wealthy customers. Alternatively, the Tribe could stretch the capabilities of its casino management team by expanding the existing casino into a resort with multiple new hospitality operations under one resort and casino umbrella. This path leverages the existing market for the current casino while further growing the capabilities of the management team. This tradeoff between developing new capabilities or pursuing new markets continues in the next stage of expansion.

Step 2 (Diversification) outlined above, the traditional gaming tribe is faced with same tradeoff. For this Tribe, this process took place at the end of the last decade, when it had to consider whether to further diversify in the wake of the significant success of their resort and casino outside of San Diego. Examining the experience it had gained in hotel and resort management, they recognized that it had developed significant skills and expertise in the general hospitality business and could utilize those capabilities to manage hotels off of the reservation. With an off-reservation venture came the need for additional financing. Reviewing its growing knowledge of casino and resort financing, the Tribe determined that it could—and would benefit most from—financing its own off-reservation commercial expansion.

Attempting to move into a new market and develop new capabilities at the same time (by building a manufacturing facility, for example) would be far too afield for the tribe and increase the odds of enterprise failure. But by incrementally growing and branching out along the markets and capabilities axis (see previous graphic), tribes can reduce their risks and diversify with a greater likelihood of success.

Step 3 Return-Driven Projects (RDP) and Self Financing begins with all the capabilities developed from past diversification efforts and the customer bases of existing enterprises. Taken together, the portfolio of investments and the inherent capabilities of this Tribe resembles a real estate firm or a company highly skilled at managing and financing large cash-driven assets (casinos, hotels, etc.). In the corporate world, the closest analogy would be a Real Estate Investment Trust (REIT). In this case, the Tribe could look to new market real estate investments in luxury apartments that leverage its ability to manage high-end real estate properties in any domestic location. Moving in the other direction, in an effort to further develop its cash management and financing capabilities, the Tribe could get into commercial banking by purchasing a small existing bank or chartering its own to service the Tribe and nearby communities. Using this model, the Tribe is able to essentially self-finance real estate or banking projects that only a decade before would have seemed entirely unrealistic without vast amounts of outside support and assistance.

“The most important thing for any tribe is not to invest in a business but to support the people and entrepreneur support. There is a real need for sound planning and to avoid going after the ‘quick buck, so the two things we look for are sustainable revenue and employment, which offer tribal members a chance to grow and have opportunities while building a sustainable revenue source for the tribe that we can build upon as a vehicle for job creation. ” — Jon Greendeer, Ho-Chunk

As you can see from this diversification progression, a Tribe can gradually expand in stages by leveraging either existing customer markets or existing capabilities to grow. By not going too far and too fast in pursuing new markets and new capabilities at the same time, a tribe can avoid higher-risk enterprises and the costly failures that sometimes result. Over time, taken in stages, diversification can be an exercise in low-risk expansion that proceeds at a pace that the Tribe can control. In addition, by connecting each stage together, a long-term strategy emerges from the distinct choice that a tribe makes at each stage between new markets and new capabilities. Blue Stone has mapped out diversification path options for many tribes at various stages of development across the country. In each case, the framework provides tribes with a clarity of choice that helps eliminate project options that are too ambitious or far afield for tribal decision-makers to effectively execute. From a financial perspective, this framework also has the indirect benefit of increased likely returns because the projects chosen are more likely to be successful over the long run.

As previously discussed, the stage-based approach to diversification can work hand in hand with the strategy of attracting incremental customer demand. Each time a tribe develops new capabilities in an existing market, it in effect captures incremental demand. Taken together, these two approaches can be extremely helpful to tribes who are seeking to plan and execute economic diversification. In our next article, we examine other frameworks for diversification that are more unique to tribes’ particular economic development situations and challenges.