Compensation is More Than a Monetary Value

Compensation is a major tool of any organization in attracting, retaining, and motivating employees. It is a systematic approach to providing monetary value to employees in exchange for the work they perform. There are many facets that impact compensation, it can include base salary or wages, incentives, benefits, vacation/sick leave, insurance, retirement, and even company culture. A strong salary structure helps ensure that pay levels for your jobs are competitive externally and also internally equitable.

Compensation is meant to attract and retain highly-qualified and dedicated individuals by providing salaries that are competitive in the market. Good compensation structures promote teamwork and create an environment of growth for employees, both personal and professional.

Employees are any organization’s greatest asset, and also the largest liability. Creating a balance between the asset and liability comes down to compensation, benefits, and workplace culture. It is important to not just look at market compensation, but also internal equity.

“Employees are any organization’s greatest asset, and also the largest liability.”

Your Internal Equity Could be at Risk

Internal equity is a new area of risk for all employers and Tribes are no exception. Identifying pay disparities in an organization and ensuring a fair and consistent method for determining compensation is important and employees are paying attention! Internal equity in an organization ensures that employees feel they are being rewarded fairly based on performance, skills, and other job requirements. With increasing minimum wages and sometimes Tribal minimums, across the country, this can create pay compression within an organization.

Pay Compression: The Enemy of Fair Compensation

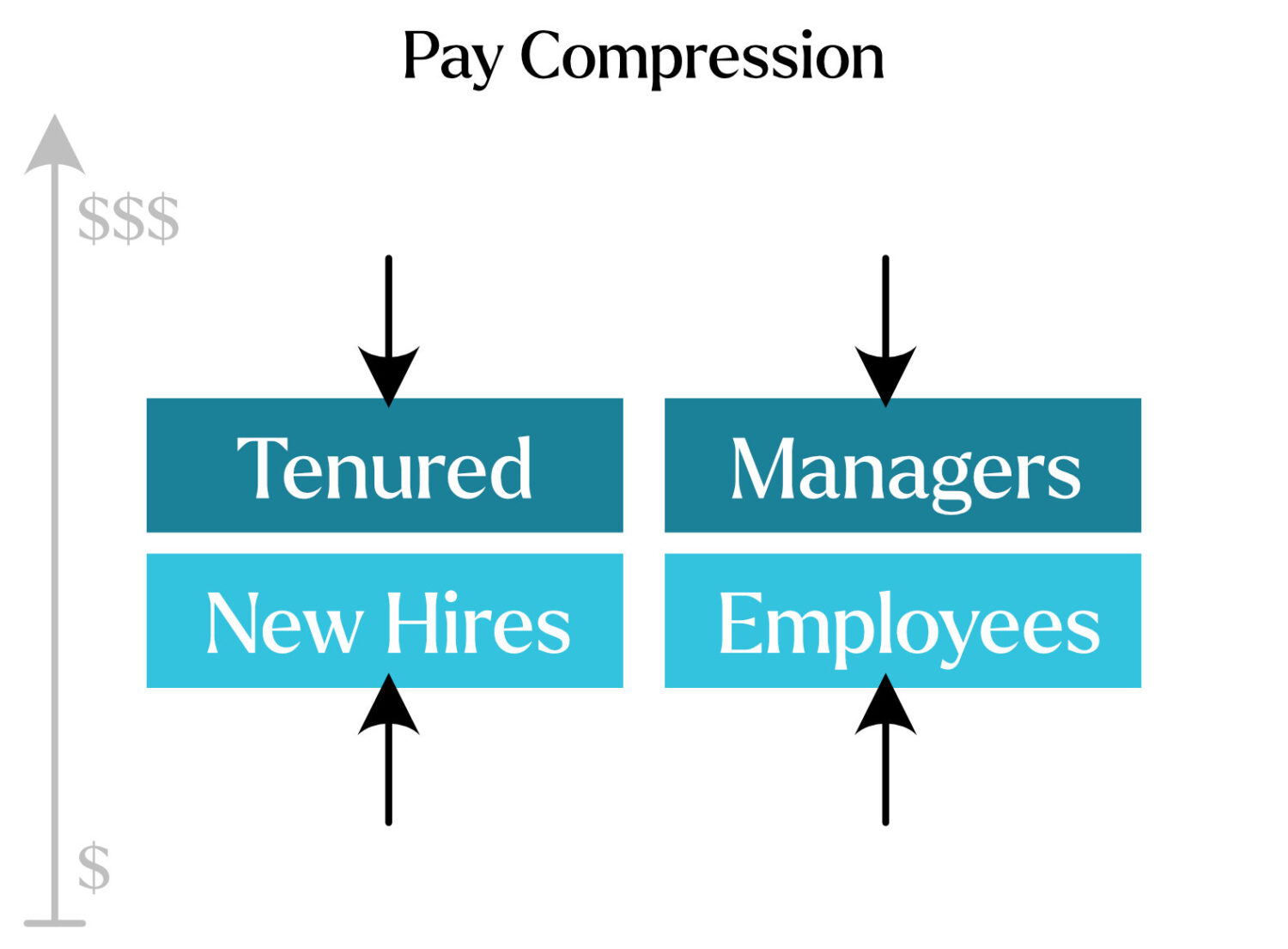

Pay compression is a compensation issue that develops over time. It occurs when there is very little difference in pay between certain employees. There are two common occurrences for pay compression:

1. Between tenured employees and new hires. When new hires join the organization at compensation levels higher than those employees that have been with the organization longer; we see this with the rise in State or Tribal minimum wages.

2. When there are small wage differences between employees and their supervisor or manager. We’ve also seen this occur where supervisors/managers are making less than those they oversee, due to the rising minimum wage. Generally, as a rule of thumb, direct reports shouldn’t exceed 90% of their supervisor/manager’s salary. Some of this can be prevented by ensuring that the spread between ranges is broad enough to accommodate this.

Pay compression can lead to turnover, as employees feel they’re being undervalued. This typically happens when long-tenured employees find out they are receiving less than new hires. This can create problems if your most tenured employees, who possess institutional and valuable knowledge, decide to jump ship. Even if they are not actively looking for a job, they can lose motivation which results in lost productivity.

Compression can also hamper recruiting efforts because of a significant disconnect between internal pay rates and what the market indicates is acceptable, an organization may lose out on the ability to recruit top talent.

As mentioned earlier, market forces or location may drive an organization to pay a higher salary in order to attract qualified talent. However, if an organization does this and fails to account for how that higher salary impacts the compensation levels of existing employees, it creates compression.

If a position has several levels of a job function with different roles and responsibilities, and everyone is paid using the same range, compression is likely. For example, if an organization has a Junior Accountant, a Mid-Level Accountant and a Senior Accountant position, they should each be in a different salary range. Combatting pay compression and ensuring internal equity can be done through analysis based on employee census data and the use of compa-ratios.

Strategies for Fixing Pay Compression

Applying Compa-ratio Analysis

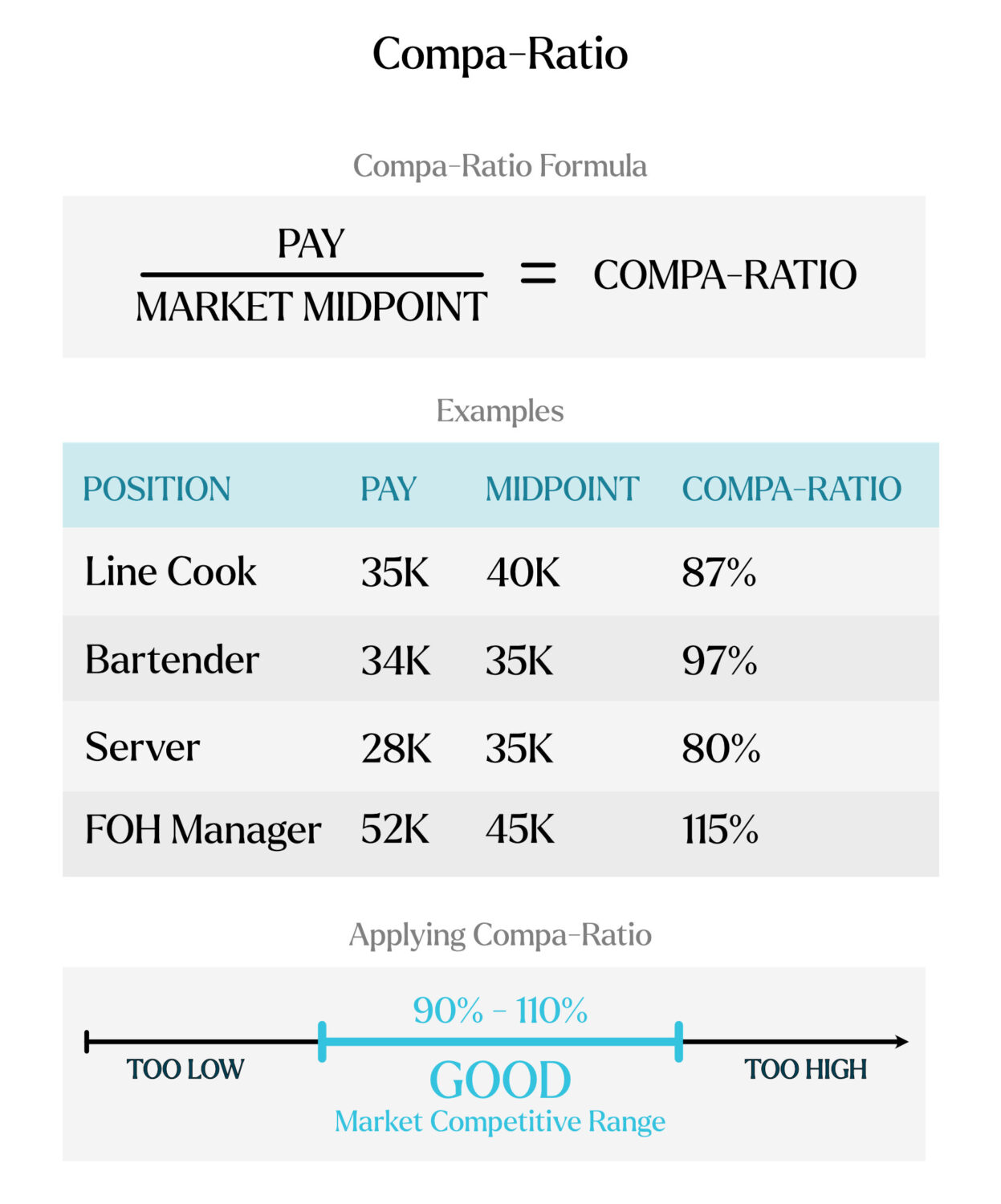

Compa-ratio is a statistic and mathematical equation that expresses the relationship between base salary and the midpoint of a salary range; it helps determine internal equity. For example, it is difficult to say, just looking at pay, if an Executive Director is being paid fairly in relation to an Administrative Assistant. By using the compa-ratio percent, we can see where each of them is falling within their respective salary range.

A compa-ratio of 100% means the employee is being paid “at market.” What we want to look for are those employees who have low compa-ratios, or are making below the minimum pay of their range.

Addressing and fixing pay compression issues can be costly, so conducting analysis and creating solutions for the organization are important even though they usually take years to “fix.” Not addressing pay compression does have consequences, including the negative impact it has on the morale of the workforce, turnover, employee disengagement, inability to recruit, and even lawsuits.

Making Pay Adjustments

Pay adjustments can be costly and sometimes cost prohibitive, and this is a good reason that HR should be working closely with Finance to address managing compensation and the staffing budget. If market adjustments are an annual part of compensation planning and budgeting, and the organization decides to monitor and adjust for pay inequity and compression, this needs to be consistently budgeted and accounted for.

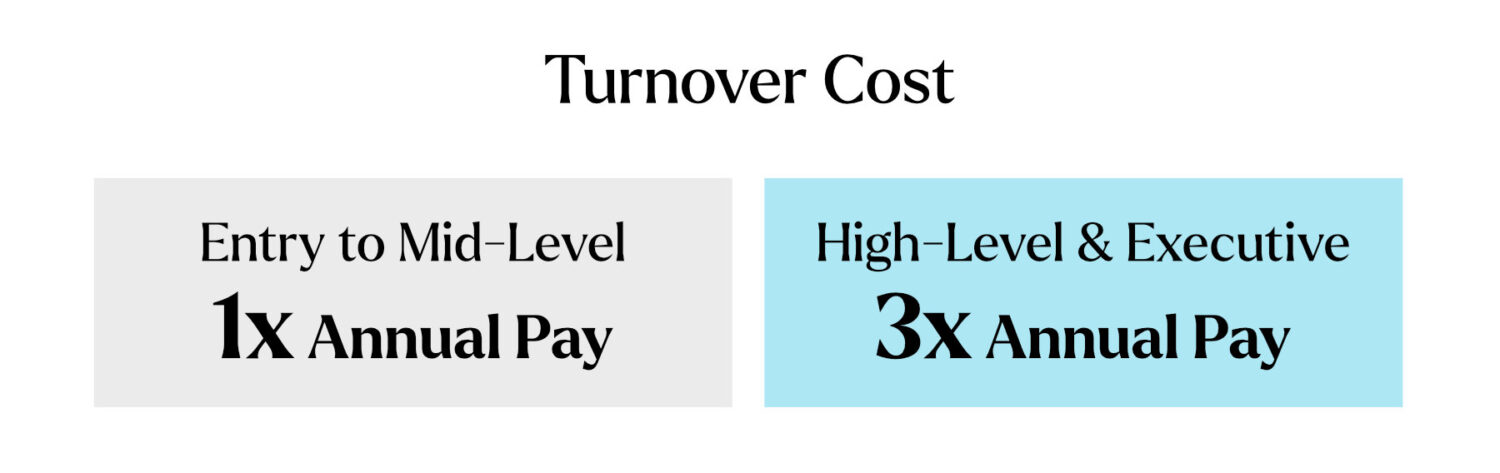

Even though the amount of pay adjustments to address pay compression is usually very significant in the first 1-3 years, it is typically less expensive than the turnover that can occur. The cost of turnover for entry-mid level positions is typically 1x the annual salary and high-level and executive positions can be up to 3x the annual salary.

Using Pay Ranges

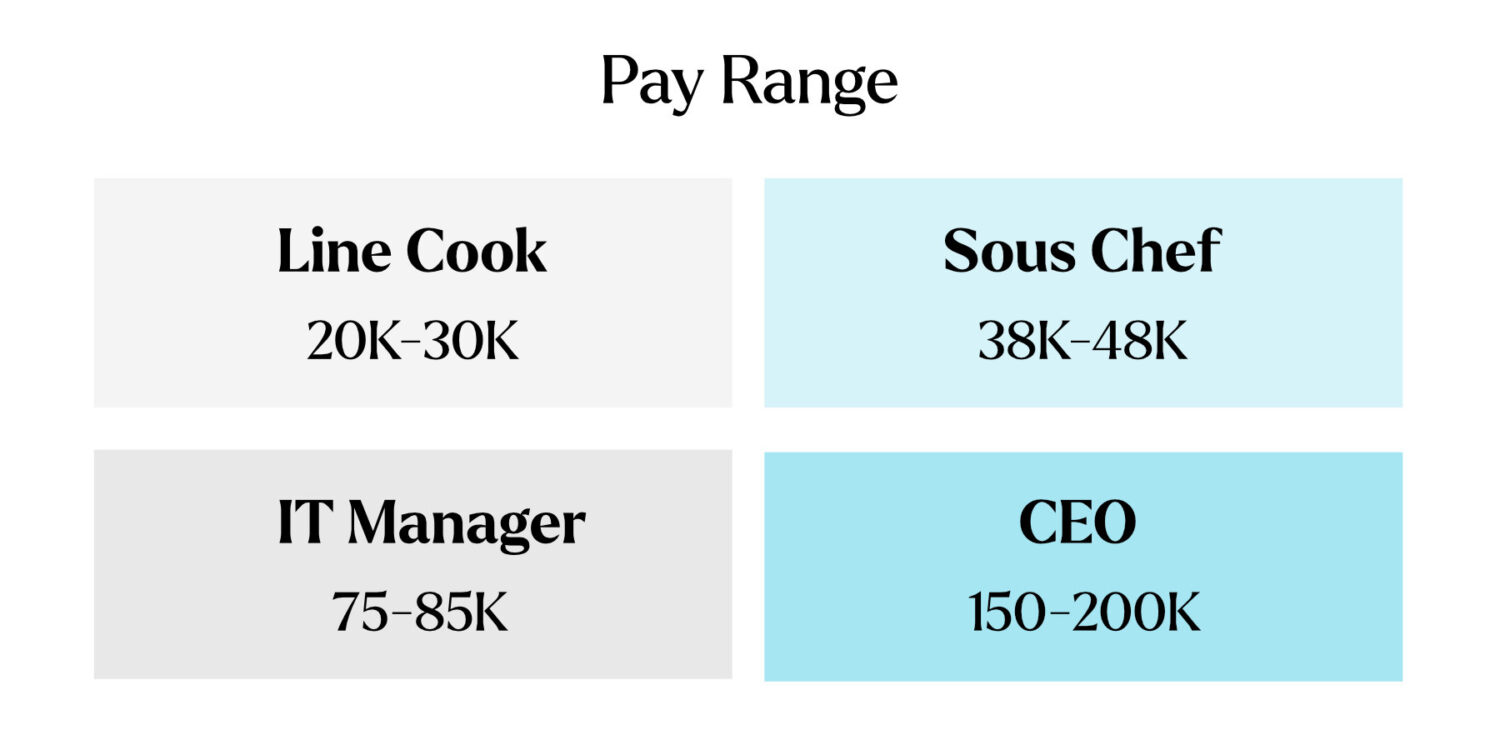

Using pay ranges will improve an employer’s ability to hire and retain qualified employees. It allows the employer to be more intentional about how they pay and why they pay what they do. Using pay ranges allows an employer to look at each job with a greater level of detail and understand how the market is valuing each position. This aligns with how employees think of their own jobs, as they understand they have a set of skills they are selling to the market.

Creating a range for each position requires an employer to gain a solid understanding of the talent market (location, size of organization, and the other employers with which they are competing for talent), make critical distinctions between types of jobs, and identify necessary skills required for each role.

Data is a key component of this process. Having access to a variety of relevant data sources that provide multiple data points is important, as not all survey data encompasses every position. Understanding benchmarks and where specialized titles compare to benchmarks is equally important. Within Tribal governments, there are many unique roles, typically found in the Natural Resources and Cultural departments, and these are not positions for which there are limited benchmarks or survey data. Understanding how these specialized roles work within the organization and which benchmark salary data to compare them to means that the structure will include these unique positions at the appropriate and competitive pay level.

Thoughtful Planning Benefits the Whole Workforce

In today’s market, we advise our partners to not fall into the trap of high minimum wages in an effort to compete against those in their area, but to be thoughtful about a minimum wage coupled with benefits and employee engagement programs in an effort to make them an employer of choice in the area.

Alicia Finley SPHR, SHRM-SCP and THRP, is the Human Resources Services Director for Blue Stone Strategy Partners. Alicia has 22 years of collective experience in the Human Resources and benefits field, as well as 11 years of project management experience, and has significant experience in consulting with Tribal clients on a wide variety of Human Resources issues.