A Low Risk, High Potential Return Opportunity

It is a Nation’s inherent sovereign authority to regulate the conduct of persons and activities within its territory and jurisdiction, including the control of economic activity within its boundaries which includes a Tribal Nation’s taxing jurisdiction and regulatory authority.

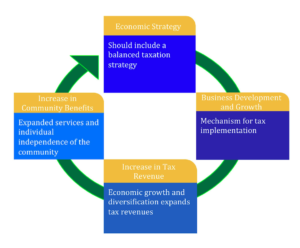

Creating a balanced tax strategy to ensure taxation is not a threat to enterprises, but rather an opportunity to execute Tribal sovereignty and maximize sovereign advantages to fund essential government services and programs. Overcoming tax implementation challenges and remembering consumers are used to paying taxes imposed by counties, states, and the federal government.

Self Analysis Questions

-

What type of taxes are we currently charging?

-

Do we have a clear understanding of our current enterprises?

- Does our community support taxation? Have we educated them on the process and benefits?

- Can we expand our current tax opportunity?

- What are our sovereign advantages regarding taxation?

- How does taxation fit with our current long-term economic development strategy?

- How does our economic governance structure maximize taxation?

14 Tribal Tax Opportunities

Each Nation requires a unique taxation strategy tied to your economic development strategic direction, maximizing your communities distinctive advantages

|

|

FIVE KEY AREAS TO SUCCESSFUL TAXATION

1. Tax Strategy: Determine the tax strategy by reviewing and aligning with the overall economic development plan

2. Tribal Code: Enact Tribal taxation law/code through the development and passing of Tribal Ordinance and Charter

3. Policies and Procedures: Develop and implement standardized, clear processes of tax collection, administrative processes, tracking, reporting, and payment to the Tribal government

4. Functional System Support: Implement functional systems support (point of sales system regarding sales subject to taxation and collection; back off accounting systems; etc.)

5. Education: Educate staff, third parties, and community

Typically can be completed in approximately (4 months)

Creating Annuity, a Reliable Income Stream of Cash Flow back to the Tribal Government

Now is the time!

to leverage your sovereign advantage of taxation to create a recurring revenue base, providing a reliable source of funding to maximize services to your Tribal Members through a strong, stable economy

Next Steps

- Ensure taxation is part of your economic development strategy

- Determine tax strategy

- Set up tax infrastructure

Media/ Document Links:

Building Stronger Tribal Economies Through Taxation Webinar:

Detailed White Paper on Taxation:

White Paper_Strengthening a Tribal Economy through Taxation